ThinkBusiness Africa, a leading voice in economic analysis and policy advocacy, is challenging the assertions made by the Corporate Accountability and Public Participation Africa (CAPPA) in its report regarding the proposed increase in Sugar Sweetened Beverages (SSBs) tax in Nigeria.

In a report released by ThinkBusiness Africa during the week titled “ThinkBusiness Africa Insight Series April 2024: CAPPA, Sugar Sweetened Beverages (SSBs) Tax, and Fiscal Policy in Nigeria”, ThinkBusiness said the objectives of a potential staggering increases in SSBs tax in Nigeria will not be achieved based on the CAPPA report.

CAPPA had in its report canvassed for an increase in SSB tax from N10 per litre to N130 per litre which represents a 927 percent increase in the current revenue from SSBs taxes in Nigeria. The report thus suggests that an increase in SSBs taxes from the current estimates of N68 billion to N729 billion annually is required to deliver a 5 percent reduction in Body Mass Index (BMI) in Nigerians over a 5-year period.

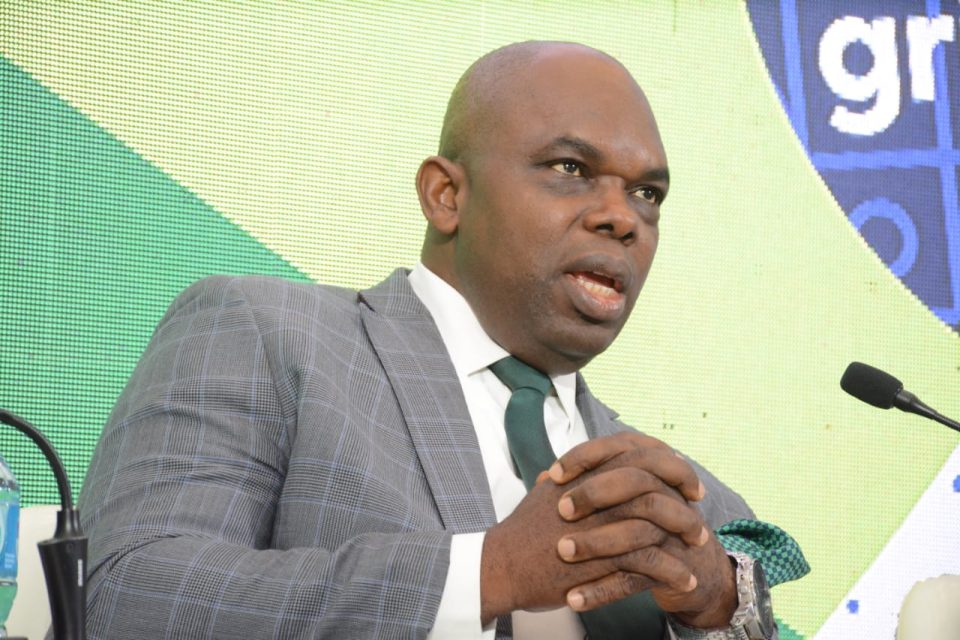

Dr. Ogho Okiti, Chief Executive Officer, ThinkBusiness Africa asserted that his company’s latest Report is careful to stress that what the CAPPA report has established is a correlation and not causation. “Using increases in SSBs taxes, assuming to deal with causation, when that has not been established, will not achieve the desired result but would have heaped heavy and unbearable tax burden on the Food & Beverage sector in the Nigerian economy”, he pointed out.

“It is staggering considering that the federal government planned health budget in 2024 is just above N1.2 trillion. If CAPPA does have its way, the government will receive about 60 percent of its health budget from the increases in SSBs taxes. In the context, increases in SSBs taxes is not just funding the control of the growth in obesity and diabetes, but funding over half of federal government expenditure on health”, he said.

Okiti also asserted that the ThinkBusiness Africa’s report seeks to stress that the underlying data for the computation and estimation by CAPPA is weak and may lead to a “trigger happy fiscal policy” approach, if adopted by the government.

He further stated that, “Acting on the CAPPA report will not deliver the objective of curtailing the rise but will also destroy the investments, revenues, and jobs in the non-alcoholic sector in Nigeria.

Okiti also pointed out that Nigeria’s sugar consumption is below the World Health Organisation (WHO) recommendations. While WHO recommends a per capita consumption of 9.1kg, Nigeria’s consumption is currently at 8.3kg. At that rate, according to him, Nigeria is one of the lowest consumers of sugar in Africa, a mere 1.4 percent of total monthly expenditure on non-alcoholic drinks.

The ThinkBusiness Africa’s Report also pointed that the finance Act 2021 was passed in the context of government’s rising debt. The proponents of SSBs tax, according to the report, did so for two major reasons – They argued SSBs taxes will curb the rise in diabetes and obesity and they also argued that SSBs taxes will bring more revenues to the government adding that in Nigeria, SSBs tax was introduced amidst government rising debts and deficits.

Okiti also asserted that the CAPPA report was inconsistent with the work of the Presidential Committee on Fiscal Policy and Tax Reforms, and avoid frequent changes in the finance bill.

“The work of the committee is expected to be completed later this year streamlining all forms of taxation and expected to be comprehensive. The suggestion in the CAPPA report negates the principle setting up this important committee. The first Finance Act was introduced in 2019. Subsequent Finance Acts have accompanied the appropriation Acts”, he said.

ThinkBusiness Africa argued that the Finance bill should be subjected to few frequent changes saying that since the 2021 Finance Act, the government has since passed the 2022 Finance Act, which also became the 2023 Finance Act. This was signed by the former President Muhammadu Buhari on the 28h of May 2023.

“If changes are made to the SSBs tax in the next Finance Bill, it will mean frequent changes to a law in which the impact on demand, investment, growth, and jobs are not clear yet and whether the aims of the legislation have been met. This is especially necessary to allow the Presidential Committee on fiscal policy and taxation complete its work”, Okiti advised.

The non-alcoholic, carbonated and beverage sector in Nigeria is extensive, multi layered, and complex. According to Statista, the market value for non-alcoholic drinks in Nigeria is estimated at USD 41 billion in 2023. This thriving sector encompasses various types of beverages, including carbonated soft drinks, bottled water, fruit juices, energy drinks, tea, coffee etc.

It plays a significant role in the country’s economy, attracting investments, contributing to growth, and providing many thousands of jobs for Nigerians. Like in many other countries, the industry is largely structured into inputs, production, packaging, distribution, with tremendous different levels and layers and participants in the Nigerian case.

A report by PwC – Non-Alcoholic drinks sectoral report: considerations for Sugar Sweetened Beverage (SSB) and single use plastic reforms (2023) pointed out key considerations for the industry in relation to SSBs tax. The main consideration and conclusion of the report is that the industry is already stretched in terms of taxation, contributing 45 percent of its gross profit as taxation that includes existing SSB tax.

Get the full details of the report: https://nigeriabusinessconsumersquare.org/