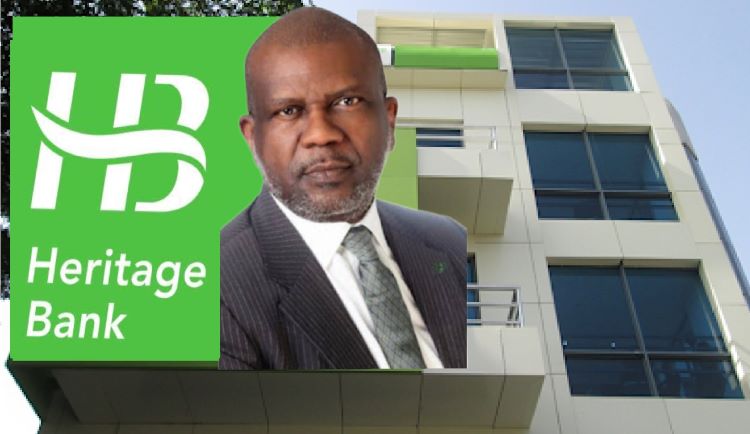

Heritage Bank led by Akinola George-Taylor, one of Nigeria’s lending establishments is once more engulfed in the web of severe crisis shaking it to its very roots.

Fresh information from informed sources at the bank indicates that Heritage Bank appears to have seen better days .Among the catalogue of issues currently hanging around the lender’s neck as the proverbial hangman’s noose includes, a serious boardroom crisis which has seen the edging out of allies of its former Managing Director and Chief Executive, Ifie Sekibo from the board of the moribund bank.

Further investigations by this medium revealed that apart from the issues of “Capital Adequacy Ratio (CAR) and the Liquidity Ratio (LR), the commercial bank is also grappling with many other crises that tend to threaten its survival. One of them is its poor services which are staring its customers in the face. Already, most of the bank’s branches are awash with complaints of unsatisfied customers whose singsong is their plans to close their accounts due to the long hours they experience to get services from Heritage Bank staff.

There are also strong indications that the lender which is currently on life support is only an inch away from the hammer of the Central Bank of Nigeria (CBN) and a take over from AMCON.

You would recall that, months ago, a banking legend and boardroom guru who was the founder of the bank bowed out upon the expiration of his tenure in line with the directive outlined by the apex bank,CBN.

This medium gathered that since his exit, things have reportedly further degenerated on the watch of the new helmsman, Akinola George-Taylor.

Even though George Taylor is faced with the huge challenge of reviving the fortunes of the ailing bank and drive growth, sources say he has instead, allegedly, instigated multiple internal crisis, in an attempt to rid the bank of those suspected to be loyalists of Sekibo and employ his own people according to an account by a reliable source in the bank.

“Some key members of the board, connived with the MD (George-Taylor) to sideline others who are considered to be loyal to Ifie and as for other members of staff who are in the same category, they have been sacked with immediate effect and that includes, Rilwan Dabiri, head of IT department in the bank and over 70 others”, the source concluded.

On the other hand, another source who spoke to us on the condition of anonymity said, “Although many have been sacked from the Bank, most of them have been indicted in one fraud or the other, thus their sacking by the new management is justified”. The source further stated that only a few who were hit by the mass sacking are victims of circumstance.

It was gathered that Rilwan Dabiri upon exit handed over the IT department to his successor who is simply identified as Akin. Since resuming his new position as head of IT, Akin had allegedly been engaging in serious insider fraud which includes unauthorized transfer of funds from the bank’s coffers into private bank accounts which he secretly operates without the knowledge of his employers.

According to the bank’s structure, only the head of IT has sole access and operates the Finacle Financial Solution platform which is solely used for online transfer of funds in the bank For this reason, Akin who has unfettered access to the platform seized the opportunity to initiate multiple transfers of about N49 billion into six accounts domiciled in six commercial banks in Nigeria.

Upon further interrogation, he was only able to drop one of the six accounts before disappearing and switching off his phones.

It remains to be seen how the new leadership of Heritage Bank Plc under the watch of Akinola George-Taylor intends to steer the lender off troubled waters, but key indicators suggest that things are not good.