Lotus Bank finds itself embroiled in controversy as a customer comes forward, alleging that the bank tampered with her account and failed to compensate her for an erroneous reversal of funds. The customer claims that Lotus Bank deleted transaction records and invaded her privacy, raising serious concerns about the bank’s ethics and practices.

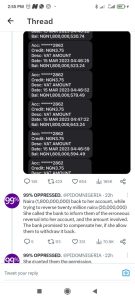

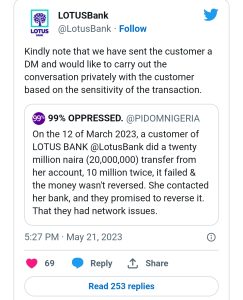

According to the customer, on March 12, 2023, she attempted to transfer twenty million naira (20,000,000) from her account, but the transaction failed and the money was not reversed immediately. After contacting Lotus Bank, she was assured that the reversal would be processed due to network issues. However, despite waiting for several days, the 20 million naira reversal did not occur, causing her distress and frustration.

Unexpectedly, on March 15, the customer began receiving multiple alerts of reversals, lasting for several hours. Astonishingly, Lotus Bank mistakenly reversed an exorbitant amount of one billion, eight hundred million naira (1,800,000,000) into her account while attempting to reverse the initial twenty million naira (20,000,000). Realizing the error, she promptly informed the bank of the erroneous reversal and the involved amount.

In response, Lotus Bank promised to compensate her but requested permission to withdraw the excess amount. The customer granted permission, and for three days, the bank left the 1.8 billion naira in her account without completing their withdrawal. However, during this time, Lotus Bank allegedly tampered with her account and erased all records related to the reversal, including SMS alerts, email notifications, and even the statement of account showing the erroneous transaction. Furthermore, the bank deleted all other recent transaction records, including transfers and POS transactions.

Disturbed by the situation, the customer visited her bank to complain and request a statement of account. It was during this process that she discovered the extent of the tampering by Lotus Bank. The bank’s actions not only violated privacy and banking ethics but also left her without any record of recent transactions, including failed transfers. As a result, she was unable to provide sufficient evidence to support her claim.

Lotus Bank has yet to provide any transaction history to refute the customer’s allegations, leaving her and others questioning the bank’s credibility. The customer is seeking redress for the failed transaction and the promised compensation that Lotus Bank has seemingly reneged on. The incident has raised concerns about the bank’s practices and highlights the need for the Central Bank of Nigeria (@cenbank) to investigate the matter thoroughly.

As the situation unfolds, Lotus Bank faces mounting pressure to address the customer’s claims and demonstrate transparency in their operations. The affected customer, supported by screenshots taken during the reversal process, hopes for a resolution to her ordeal and urges the bank to fulfill its responsibilities promptly. The involvement of the Central Bank of Nigeria is seen as vital to ensuring a fair and impartial investigation into the alleged misconduct by Lotus Bank.